Conflict Oil and Gas

Air Date: Week of April 1, 2022

Russia’s oil industry has constituted around 40% of the nation’s GDP in recent years, and is key to funding its war against Ukraine. (Photo: Pixabay, Pixabay License)

Fossil fuel markets are often volatile, especially around wars, while renewable energy resources tend to be more isolated from conflict. And as oil prices surge the world stands on the precipice of a choice between even more climate-killing drilling and a transformational shift towards clean energy that could change the geopolitical landscape. Host Steve Curwood talks to Collin Rees, the U.S. Program Manager at Oil Change International about the state of global oil markets and what this moment means in the scope of the world’s dependence on fossil fuels.

Transcript

CURWOOD: It’s Living on Earth, I’m Steve Curwood.

Even before Russia invaded Ukraine natural gas and crude oil prices started surging as global markets reflected the risks. The fossil fuel market is often volatile, especially around wars. The Arab oil embargo in 1973 after the Yom Kippur war between Israel, Syria and Egypt led to sky high prices at the gasoline pump in the US as Middle Eastern oil was cut off from the US and other countries that helped Israel. Today the US itself is reducing supplies with an oil embargo against bellicose Russia, with price shocks again hitting US filling stations. Renewable energy, on the other hand is steady as, well, the sun. Renewables produce clean, domestic, energy with fuel supplies isolated from conflict and the turbulent whims of international markets. So, in this unique moment in oil politics, Collin Rees, the U.S. Program Manager at Oil Change International, argues that we stand on the precipice of a green-energy revolution, and He joins me now for more, hi there!

REES: Thanks so much, Steve. It's great to be here.

CURWOOD: So last week when he was in Europe, President Biden got together with essentially the head of the EU Ursula von der Leyen and made this pledge that the United States is going to step up with natural gas for Europe. How could that be done? How possible is that and how advisable is that?

REES: Yeah, I think the biggest question and the one that was pretty unclear in last week's announcement was that we don't know if this means they will actually expand production and build new LNG and the gas infrastructure, or if it will be shifting existing capacity. Right now, we send a medium amount of gas and LNG to Europe, the US exports quite a bit more LNG and natural gas. And a lot of that goes to Asia, some of it goes to Latin America, some of it goes to Africa. And so, provided that other countries are willing to be flexible, or to shift a little bit, one thing the United States could do is shift some of those exports from other countries and send them to Europe instead. None of this is an ideal situation, but that would be the best option in our mind, because what the climate cannot afford is to build new long-lived infrastructure. So I think the biggest danger of this announcement was if it locks in new production.

CURWOOD: So by the way, how much natural gas are the Europeans looking for? I mean, what difference out of our current natural gas production would the U.S. be able to make?

REES: Yeah, the announcement talked about both a short term and a long term goal. There is talk of increasing capacity by 15 billion cubic meters of gas by the end of the year, and then securing commitments for an additional 50 billion cubic meters per year by the end of the decade. So that's a short and medium-term goal, it would be an increase of I think, around 30 to 40% from our current levels. There is a great analysis that recently came out from E3G and and a couple other think tanks showing that Europe could meet I think two thirds of that goal purely through energy efficiency and clean energy and aggressively trying to reduce demand for natural gas over the next few years. Make sure supply lines run a little differently but then we wouldn't have to be building out new long lived infrastructure.

CURWOOD: Now talk to me about the international oil markets here. The US is currently a net exporter of oil. And yet some say that we're dependent on foreign oil. Explain what's going on there.

REES: Yeah, when we talk about energy independence, it's not really a frame that makes sense. That is a frame that has been invented by the oil and gas industry and Republicans and as well as democratic boosters of the fossil fuel industry. It's an extremely connected global market. Prices are set on the global markets. We couldn't insulate ourselves from the natural volatility and boom bust cycle of the oil and gas industry. The other specific piece here is that the US imports a medium amount of oil. And part of the reason that is done is two reasons. One is it's actually a lot easier to ship in a little bit of oil from Asia over the Pacific Ocean, if you're talking about oil that's needed in Alaska, or Hawaii, or parts of the West Coast. And the second and perhaps more important reason is what we as the US tend to export is heavier crude oil, which needs more refining. What we tend to import is lighter crude oil that needs less refining, and is used for slightly different uses. So it's not simply that all oil is created equally. And that we can immediately switch between different uses. It's actually different types of oil that we don't necessarily produce in the same amounts as what we need.

CURWOOD: In other words, in the U.S. we make beer and then overseas, they make wine?

REES: That's one way to think about it.

CURWOOD: So by the way, what kind of money are we talking about for Russia when it comes to oil and gas? How big are the numbers for them? And therefore, how important are these boycotts of Russian oil and gas?

REES: When you hear talk about fossil fuels fueling Putin's war machine, that's not an exaggeration. Fossil fuel revenue has ended up around 40% of the Russian budget in recent years. Oil Change recently put out a piece of analysis with Greenpeace USA and Global Witness showing that Western oil companies so Chevron, Exxon, Shell, Total, BP and others have contributed almost $100 billion to support Russia's economy through taxes and other payments via oil and gas operations over the last decade, or since the invasion of Crimea. So these boycotts, they are about isolating Russia on the global geopolitical stage. If it does succeed in actually limiting the ability of Russia to export these fossil fuels, that would be a game changer in terms of the money that's actually flowing to Russia.

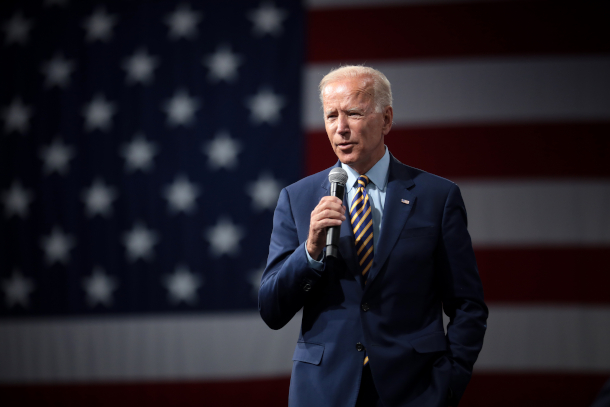

The Biden administration has opened the Strategic Petroleum Reserve in a bid to dampen the impact of high prices at the gasoline pumps, and is calling for the domestic fossil fuel industry to increase output over the near term. It remains to be seen how the administration’s policy will impact the industry in the coming years and efforts to reduce climate changing emissions. (Photo: Gage Skidmore, Flickr, CC BY-NC 2.0)

CURWOOD: Some say that natural gas is a better deal than coal or oil. Others say that leakage of methane associated with the production and transportation of natural gas wipes out any advantage there. What do you say?

REES: So there are two reasons that natural gas is not any sort of bridge fuel. The first is methane leakage. Methane is a very potent and powerful fossil fuel. And in practice, as you mentioned, methane leakage is a severe problem around the world. And it's also something that's very difficult to measure. Even in the US, we have almost no idea how much methane is actually escaping along the natural gas supply chain. It happens at essentially every stage of transportation that some amount of methane leaks out, and if more than 3% of the methane leaks out, it ends up erasing the climate benefit of natural gas. We just saw a study from the New Mexico Permian Basin one of the largest sources of gas and oil here in the United States, which preliminarily showed that it could be as high as 9% leakage at different spots. The second piece here is that we are so deep in the climate hole just being better than coal isn't actually sufficient. We have done a lot of analysis at Oil Change International, the International Energy Agency has confirmed that we can't afford any new fossil fuels. And so even if we were to assume zero methane leakage, new natural gas still would be bursting our carbon budgets.

CURWOOD: Let me ask, where does Chinese demand fit into the world energy markets now?

REES: Chinese demand is increasing at a pretty substantial rates. China and other countries in East Asia have been some of our largest clients for U.S. natural gas over the last few years. And also from Russia. They've increased their imports of Russian oil and natural gas over the last few weeks. In some ways, they think they've not taken the political stance that other countries and countries in the West in particular have and continue to import fossil fuels from a pretty wide variety of sources around the globe.

CURWOOD: What about Iranian oil? It's been blocked from the market by the U.S. with sanctions, but under the present conditions, where do you think it might be going?

REES: One of the biggest discussions that's going on right now is how to handle the oil coming out of traditional U.S. enemies, I'll say, at least for the last couple of decades, places like Iran, places like Venezuela. The Biden administration has been in contact with the governments of those places, there's discussion of more of their oil to go to places like Europe. This is a moment in which there's potential to reshape existing diplomatic relationships. One of the big questions is, how does this impact Iran's relationship with other oil exporting states in the Gulf, the Persian and Arabian Gulfs? Those are sort of the questions that we're seeing right now.

CURWOOD: It's a bit of the enemy of my enemy is my friend?

REES: That's exactly what we're seeing. I think it's laying buried how in fact, it's not necessarily deeply rooted in a moral argument, it's convenient for the U.S. to be opposed to these countries until they really need what they have.

CURWOOD: So somebody listening to us right now might want to know why is what happens in Russia makes prices at the pump for gasoline in California rise? What exactly happens in a situation like that?

REES: The price of gasoline in a place like California is dependent on a number of factors. One of those factors is the actual acquisition of the crude oil. Another is the cost of refining that oil. And then you have a couple different levels of taxes. Some of those things have remained constant, there hasn't yet been a big change in the gas taxes, for instance, at the state or federal level, though that's being discussed. Refining prices have increased slightly due to overall inflation due to a labor shortage, it's important to remember that oil prices were already relatively high and increasing before the invasion of Ukraine. But the biggest component here is the global price of oil and how much it costs to obtain a barrel of crude oil. And so that's the piece that we've seen increase significantly in the last few weeks. Part of that is because increased demand for non-Russian oil has caused prices to increase a little bit. The other thing is investor fear. Markets run a lot, not just on physical realities, but actually on on fear and kind of assumptions what might happen next. There is a fear that this tragedy in Ukraine could continue to unfold for some time that this is not going to be a short term blip. And so I think prices have adjusted quite a bit higher in response.

Gas prices reach new highs all across the U.S., with some regions paying close to $6 per gallon. (Photo: Don Harder, Flickr, CC BY-NC 2.0)

CURWOOD: What kind of policies do you think the Biden administration should be advancing to reduce the demand for gasoline, as well as natural gas, because it is such a sensitive place for consumers and people on limited incomes to encounter?

REES: I think the most important thing to understand is that the fossil fuel industry is trying to use this as a moment to boost their own profits and to lock in a future for themselves. Essentially, what we're seeing right now is that even as oil prices have come down, gasoline prices have not followed them. We're seeing oil companies raking in massive record profits, those profits are of course not being passed along to consumers. And I think that's, that's a scandal. That's an outrage to the American people. So I think one important thing that's been introduced in Congress in the U.S. there's been discussion in other European countries as well, but is essentially a tax on the hundreds of billions of dollars that the fossil fuel industry is making while working people are still suffering. And then I think that is money that could be targeted at low-income consumers could be used to fund the build out of more equitable transportation infrastructure to make electric vehicles cheaper. And then the second thing is sort of related to that. The Biden administration has a lot of executive power that it hasn't really used yet to do things like ramp up the production and adoption of renewable energy technology and of energy efficiency technology. This is something that President Trump wasn't hesitant about using. In cases of emergency the Biden administration shouldn't be either.

CURWOOD: Now there have been some who say that should to green energy will push things towards protectionism as there is competition among the green power countries. What geopolitical shifts do you think we should look for from a global transition away from fossil fuels and oil to green renewable energy?

REES: I think we've seen a system in the fossil fuel industry in which power is very concentrated in the hands of just a few specific companies, we have an opportunity to produce a system in which many more energy-producing systems are actually owned by the communities in which they operate. You have local solar panels and low solar arrays. These are us examples. But there's even more potential, particularly in Africa and Southeast Asia, to build out much faster and cheaper access to energy by using renewable energy. These are the sorts of things I think we should be focused on at the structural level. And the other piece to this is that we don't want to be extracting the raw materials required for renewable energy in negative ways. We don't want to be creating sacrifice zones. We don't want to be making the global south yet another extraction zone for Imperialism, as we've seen in the past.

CURWOOD: What role if any, do you think nuclear power should play in this shift away from fossil fuels?

REES: I think it's entirely reasonable to recognize that it might have some benefits in the short and medium term. But to recognize that on the long term, new nuclear doesn't make any sense. New nuclear is prohibitively expensive, it is vastly cheaper and faster to build out renewables technologies, and we have those technologies available now.

CURWOOD: Of course, the nuclear crowd would say, renewables are intermittent, we don't have the storage yet really effectively. So nuclear over the short or medium term does offer relatively carbon-free baseload power. And you say?

REES: I would say intermittency is not nearly as much of a problem for renewables as it was a decade ago, we have advanced and rapidly advancing battery technology. And so I think that's the sort of thing that our subsidies should be going to.

CURWOOD: Collin, with the pandemic, Russian invasion of Ukraine, and other shifts in the world. Some say this is an inflection point in our species's history, looking at the world of energy over the medium and long term, what are you hoping for? What are you concerned about?

REES: I think this is a moment in which the world will decide whether we are going to step up and meet the climate crisis, or whether we are going down a path of drastically increased climate impacts, increased climate displaced peoples and migration as a result of the climate crisis, further tethering our economies to the volatility of things like oil and gas and conflict. In particular, I think we've seen in recent years for the first time countries get serious about talking about ending finance for fossil fuels. We saw in COP 26 at Glasgow, the launch of the Beyond Oil and Gas Alliance: the first dedicated alliance of global governments committing to actually stop the expansion of the supply of fossil fuels. We need to be reducing both demand and supply in tandem, and this is the first sign that global governments are agreeing. So I think the big question is, will that momentum to address both the demand and the supply of fossil fuels together, continue or will something like this tragic invasion of Ukraine throw it off course?

CURWOOD: Collin Rees is the US Program Manager for Oil Change International. Collin thanks so much for taking the time with us today.

REES: Thanks, Steve. It was great to be here.

Links

Oil Change International website

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth