Cuts to Clean Energy Tax Credits

Air Date: Week of May 30, 2025

The House narrowly approved the “One Big, Beautiful Bill” with a 215–214 vote, allowing it to move forward. (Photo: Frank Schulenburg, Wikimedia Commons, CC BY-SA 4.0)

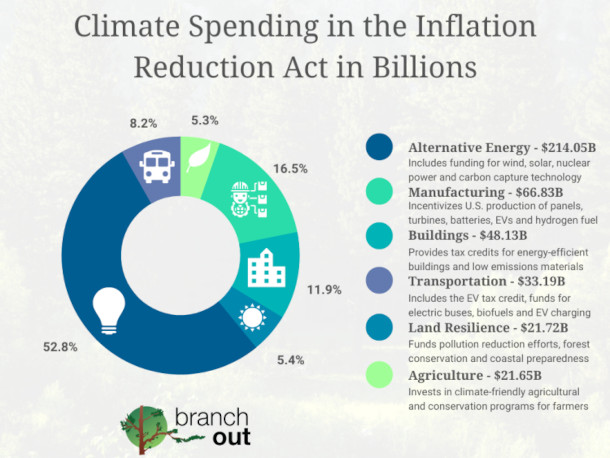

The "One Big Beautiful Bill Act" that passed through the House of Representatives on party lines guts multiple provisions from the Inflation Reduction Act, terminating or reducing tax credits for electric vehicles, clean hydrogen and advanced manufacturing. Dan Gearino, a clean energy reporter with Inside Climate News, talks with Host Paloma Beltran about why over a dozen House Republicans who had voiced support for clean energy tax credits ultimately voted to cut them, and what could happen as the legislation moves to the Senate.

Transcript

DOERING: It’s Living on Earth, I’m Jenni Doering.

BELTRAN: And I’m Paloma Beltran.

The Inflation Reduction Act or IRA that was passed during the Biden administration included a wide range of investments in renewable energy projects and tax subsidies. But on May 22nd the "One Big Beautiful Bill Act" as it’s officially titled was approved by the House of Representatives by just a 1-vote majority. This bill contains much of President Donald Trump's domestic policy agenda. And guts multiple provisions from the IRA, terminating or reducing tax credits for electric vehicles, clean hydrogen and advanced manufacturing. Joining us now to discuss the impact of this bill is Dan Gearino, a clean energy reporter with our media partner Inside Climate News. Dan, welcome back to Living on Earth!

GEARINO: Glad to be here.

BELTRAN: So, there's been a lot of chatter recently about this "One, Big, Beautiful Bill" that passed through the US House of Representatives. What is the main goal, and how does energy factor into it?

GEARINO: So, the bill does a whole bunch of things, and I think one of the most important things to remember from the perspective of somebody who cares about the energy provisions, is that the energy provisions are not a huge part of the bill. This is a bill that deals with extending tax cuts, makes modifications to Medicaid, does a whole bunch of things. The energy provisions are largely about cutting or accelerating the phase out of tax credits under the Inflation Reduction Act so that you can free up more money so that the tax cuts can be partially paid for. So, if you're someone who cares about wind power, solar power, battery storage, electric vehicles, a whole bunch of the federal tax credits that help to support those things are either going away or are gaining restrictions or other impediments, and this is really harmful to a whole bunch of industries. But when you watch the debate, a lot of the discussion is about other things, because the energy provisions are not one of the top line concerns. It creates this kind of a strange atmosphere for if you're an energy company, if you're someone who has rooftop solar or an electric vehicle or wants to buy one of those things, there's this kind of dissonance between the discussion of stuff that's really important to you and this kind of appearance that it's not nearly as important in the discussion that's taking place, that took place in the house, and then it's going to take place in the Senate.

The House version of the “One Big, Beautiful Bill” removes the 30% tax credit that reduces the cost of rooftop solar. (Photo: Gray Watson, Wikimedia Commons, CC BY-SA 3.0)

BELTRAN: Now, Dan, to what extent have the clean energy tax credits been benefiting communities and individuals across the US?

GEARINO: The Inflation Reduction Act includes a $7,500 tax credit that will reduce the cost of buying an electric vehicle. So, if you buy an electric vehicle, it costs less. It's a real incentive to buy an electric vehicle. There's also a $4,000 credit for buying a used electric vehicle if it meets certain qualifications. There is a tax credit that reduces the cost of buying rooftop solar makes it so that if you buy a rooftop solar system for your house, certain percentage of it can be deducted.

BELTRAN: So, what jobs are at stake in Republican districts when it comes to the rollback of clean energy tax credits?

GEARINO: So, we're hearing comments from union members and union leaders. You're hearing comments from trade groups, but I would say that one of the important dynamics here is that we are still early in the implementation of the Inflation Reduction Act. So, when we talk about lost jobs, we're talking largely about jobs that haven't started yet. These are factories that are being built. Some of them are factories that have been announced but have not broken ground yet. So, if this was five years from now, you would have tons of workers saying, don't hurt my job. You definitely do have some places where there are current jobs that stand to be harmed by this, but by trying to impair these industries, as this bill does, you're catching it at a time before some of the natural constituencies that would support these tax credits have really had enough time to come into being. There's a gigantic manufacturing plant in, say, Georgia, South Carolina, and it's either in the very early stages of operating or is not opened yet. You know, it’s a different debate than if that plant had been around for a while.

Less than 6 months into his second term, President Trump targeted the Inflation Reduction Act to make changes to energy policies among other things. (Photo: Official White House Photo, Wikimedia Commons, public domain)

BELTRAN: Are there any major manufacturers that we can name who are going to be impacted by this bill?

GEARINO: Well, when you're talking about manufacturing of solar panels, of batteries for use in EVs, batteries for use in stationary energy storage systems. Manufacturing of a bunch of different technologies, and a lot of these companies are household names, companies like Ford, Honda, major automakers, are getting some of the manufacturing credits. But it's important to specify here that the manufacturing credits are, it isn't like the manufacturing credits are going to, you know, snap your fingers and they're gone. What's happening with those is more nuanced, but the consumer credits will go away pretty quickly. So, if I'm a company that is spending a whole bunch of money to build a plant to build batteries for electric vehicles, and many major automakers are doing that in this country. The tax credit that allows me to offset some of the costs for setting up that plant will remain, but the consumer credits are going to go away. So that means that you're reducing demand for the product, and that means that those factories are going to have fewer customers for the things that they're making, and for people in these industries, they say it kind of has to be on both sides. It has to be both on the consumer side, and it needs to be on the manufacturing side. It's not like everything that was in the Inflation Reduction Act just goes away. Most of what goes away quickly are the things that consumers would directly benefit from.

BELTRAN: And House Republicans initially raised concerns about the bill potentially gutting IRA credits. What led to their change of heart? You know, some environmental groups have said that they view this as a "monumental betrayal."

The Inflation Reduction Act played a major role in providing energy tax credits that would ultimately reduce the price of electric vehicles and rooftop solar. (Photo: Diogo C, Wikimedia Commons, CC BY-SA 4.0)

GEARINO: There is this recurring theme whenever renewable energy policy comes up in a highly partisan context, where moderate Republicans, oftentimes Republicans in narrowly divided districts, districts that may vote Democrat for president, will say that they support a lot of these consumer facing tax credits. They will say that they support, basically support, most, if not all, of what was in the IRA. It was a bill that had a bunch of stuff that was really popular and helpful to red states and red districts. So, there are Republican members of Congress who say, be really careful in the way that you deal with these tax credits. But when it's a very close vote those members, they don't kind of put their votes out there. It's not a deal breaker for them. So, this bill passed the House 215 to 214, there were 14 Republicans that had a joint statement basically saying, be very careful with anything dealing with these tax credits. Some aspects of these tax credits should be preserved. Zero of those 14 ended up voting against the bill. So it's one of these things where, if I'm a local activist who supports rooftop solar, who supports actions that will slow the advancement of climate change, it really can be frustrating, because it seems as though a lot of the moderate Republicans who said they cared about this kind of care about it in terms of just saying they care about it, but when it comes time to actually vote on it, it's not a deal breaker issue for them.

BELTRAN: So, we've talked about the House Republicans and how many shifted their support in favor of the bill. But how does the Senate play a role in the outcome of this bill?

GEARINO: I wouldn't be surprised if you see some substantial changes on this bill as it goes to the Senate. We're already seeing a variety of objections to what the House produced. You're seeing concerns about just basic budget issues, about whether the spending is sustainable, when I say the spending, I mean, are the tax cuts paid for, or is this all just going to balloon the deficit? It's going to balloon the deficit. But the question is kind of how much and whether or not that's accurate accounting. You are seeing discussions of how to modify what the House did on some of the IRA credits. I wouldn't be surprised if you see modifications in some of the IRA manufacturing credits. I'm not going to make any predictions about how long this is going to take on the Senate side, but I imagine there's some pretty tough conversations happening right now about what changes need to happen and then whether those changes would be acceptable to the house.

Dan Gearino is a clean energy reporter with Inside Climate News, covering renewable energy and utilities (Photo: Dan Gearino)

BELTRAN: So, Senator Lisa Murkowski from Alaska has expressed her support for the energy tax credits. And of course, Alaska is a major energy producing state. What's in it for her state? You know? Why did she express her support?

GEARINO: Lisa Murkowski has been a leader in the Senate in supporting investment in U.S. energy production across the board. So that means supporting oil and gas. That means supporting renewables. And the Inflation Reduction Act was a law that, in a pretty broad way, supports expanding the U.S. ability to produce energy. So, when Lisa Murkowski expresses doubts or skepticism or opposition, some of that comes from Alaska's status as a major energy producing state. I think her larger point is that the U.S. needs to, well, have a coherent policy. Can't be just wildly gyrating in terms of its energy policy. Needs to have a policy that encourages investment and that rewards investment. And to pass the Inflation Reduction Act, and then just a few years later, drastically change it, is bad for business, she would say. And that's kind of where she's coming from. She's just one vote, though. So, in order to really necessitate substantial changes, you would need to have four Republican senators who kind of dig in and say that this is they can't support the House version of this. And the question is, kind of who those four are.

BELTRAN: And we don't know yet what will happen with all of the provisions in the Inflation Reduction Act, but how much of a lasting impact might the Inflation Reduction Act have on the clean energy industry, regardless of whether these rollbacks become law?

GEARINO: The Inflation Reduction Act is by far the most substantial in terms of just about any way you want to measure it, bill advancing renewable energy, electric vehicles and various energy technologies that the country has ever had. I mean number one by a lot. Number two is way far behind. So, what its legacy will be depends a lot on how many of these factories end up getting built and how successful they are. Do these factories that were built because of the tax credits end up being successful, end up employing lots of people, end up making a lot of money for their owners, and end up contributing to a kind of more robust and diverse economy in the US, some of them will. It's just a question of how many, and so we don't really know yet. So, nothing can take away the IRA status as being kind of the biggest that ever was, but its long-term effect depends on decisions that are yet to be made.

BELTRAN: Dan Gearino is a clean energy reporter with our media partner Inside Climate News, covering renewable energy and utilities. Dan, thank you so much for joining us.

GEARINO: Thank you.

Links

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth