Investment Risks from Climate

Air Date: Week of March 22, 2024

The new SEC rule will require companies to be more transparent about their greenhouse gas emissions and the climate-related financial risks they face. (Photo: Richard Bett, Flickr, Public Domain)

Climate disasters, adaptation costs and market shifts threaten the value of public companies that are inadequately prepared for climate change. So the Democratic majority US Securities and Exchange Commission recently approved a rule that will require public companies to inform investors about their greenhouse gas emissions and climate risks. Emeritus Professor Pat Parenteau of Vermont Law and Graduate School joins Living on Earth’s Steve Curwood to explain the rule and the pushback from industry and several Republican-led states.

Transcript

O’NEILL: It’s Living on Earth, I’m Aynsley O’Neill.

DOERING: And I’m Jenni Doering.

During the Great Depression President Franklin Delano Roosevelt signed into law the Securities Exchange Act of 1934, to help safeguard US financial markets against collapses like the Wall Street Crash of 1929. That was decades before scientists alerted the world to the problem of climate disruption, which is creating new financial risks because of just how expensive it is. Climate disasters now cost the US around $100 billion every year. And adapting to sea level rise, extreme heat and hurricanes requires significant and costly upgrades to infrastructure and buildings. The climate emergency mandates a rapid shift towards cleaner energy, bringing new economic opportunities but also tanking the value of fossil fuel assets. So the financial regulatory body that was created by FDR recently approved a rule that by 2026 will require public companies to inform investors about their greenhouse gas emissions and climate risks. The three Democrats on the Securities and Exchange Commission all voted for the climate disclosure rule while their two Republican colleagues voted against it. The fossil fuel industry immediately pushed back against the rule and filed several lawsuits with the help of conservative states, resulting in a temporary stay by the 5th Circuit Court of Appeals. The opposition is part of a broader challenge by Republicans to the right of agencies to regulate on the environment, from protecting fragile wetlands to setting air pollution standards. Pat Parenteau, Emeritus Professor at Vermont Law and Graduate School, joined Living on Earth Host Steve Curwood to explain the SEC rule and the pushback.

CURWOOD: So what exactly is this SEC rule? And what does it require? And why is it such a big deal?

The SEC recently backed off from requiring disclosure of Scope 3 emissions. Scope 3 emissions refers to greenhouse emissions by the end consumer, like when people burn gas in their cars. (Photo: Erik Mclean, Unsplash)

PARENTEAU: Right, so it's requiring for the first time that companies disclose their greenhouse gas emissions, and also their plans for addressing the threats and the financial risks, that climate change poses, that's a variety of risks, physical risks to their assets and their facilities, transition risks, because we're moving out away from fossil fuels into new forms of energy and transportation, liability risks, from the lawsuits that have been filed by states and counties and cities across the country, and even indeed, across the world, reputational risks and so forth. So, this rule for the first time is telling these companies that they have to be more forthright in what their emissions are, and also what they're doing about it, and also how much they're spending, and what the value of their assets are going forward and so forth.

CURWOOD: Now why is the Securities and Exchange Commission, the SEC, allowed to do this? I gather, it covers publicly traded companies. But what's the rationale that they could regulate this?

PARENTEAU: Yeah, the rationale is that they have to ensure that investors have accurate information about the value of the companies they're investing in, and the risks the financial risks that companies are facing. The opponents of the rule are claiming it's just climate policy or environmental policy. SEC is saying no, it has to do with financial risks. And so therefore, the real question is going to be is SEC within the scope of its authority as given to it by Congress from really the 1930s when the Securities and Exchange Commission Act was passed.

The new rule quickly faced legal challenges from the fossil fuel industry. (Photo: AP, Pexels)

CURWOOD: So, this will be settled in court, although one would think that the SEC has the right to raise the question of these companies going to be viable going forward given the climate emergency?

PARENTEAU: Well, that's right. And it isn't the first time actually that the SEC has addressed both environmental issues generally, and the risks of pollution and liability for pollution, oil spills, for example, which can have major billion dollar consequences. Nor is it the first time that the SEC has issued guidance on climate risks. This is the first time they've actually adopted a rule that has the force of law with penalties for non-compliance. So it's definitely a step up from where SEC has been before, but it's not brand new.

CURWOOD: Now, as this rule was getting put together, there were a number of things that were eliminated from the proposed rule that what was finally published, what was changed? And how does that by the way, compared to what's going on in Europe and what California is doing?

Compared to the new SEC rule, emissions disclosure requirements are more rigorous in California, which has the fifth largest economy in the world. (Photo: Peter Miller, Flickr, CC BY-NC-ND 2.0)

PARENTEAU: Right. So the proposed rule went all the way to require disclosure of emissions associated with the company's supply chains and with their end use by consumers, that would be us right? People that go to the gasoline station and pump the gas of Exxon and BP and Shell and so forth. It's called Scope 3 emissions, and they comprise the largest percentage of emissions attributable to these companies. But they are extremely difficult to assess and quantify, because, of course, you're talking about literally millions and millions of consumers using these products. So the SEC backed off from requiring disclosure of these so called Scope 3 emissions. You mentioned that companies are already subject to these disclosure requirements that are more rigorous than what the SEC has proposed in California for companies doing business there, California being the fifth largest economy in the world, and also companies doing business in Europe, where the European Union has imposed even more rigorous disclosure requirements. So in many ways, this is not new to these companies. They're either doing it or they're being required to do it in other contexts. The SEC did a couple of other things to water down the final rule. One, they increased the number of companies that are exempt from any disclosure requirements. So now they're just focused on really the largest companies in the world that trade publicly. And they also gave to companies the option of determining whether the risks from climate related disasters are material to the individual companies. That introduces a sort of wildcard into this equation when you have to have individual companies determining: Do we consider the risks to our business plan material enough to disclose to the public?

CURWOOD: Wow, I think the analogy is having the fox have the keys to the henhouse.

PARENTEAU: Yeah. Right the foxes, making sure the chickens are all safe and secure. There is oversight, so once the determination is made, that a company has acknowledged or been told by the SEC, that it's facing some material risks, that calculation of you know, the quantity of the emissions, the level of threat from the physical impacts of climate change, those kinds of things have to be independently verified. That's going to introduce yet another level of analysis for investors to protect them from investing in really risky assets. The danger of stranded assets, if companies don't seriously start moving away from fossil fuels, a lot of the assets on their books are going to be stranded assets, and investors will be left holding the bag.

CURWOOD: Stranded assets such as an untapped oil field that they'll never be able to use.

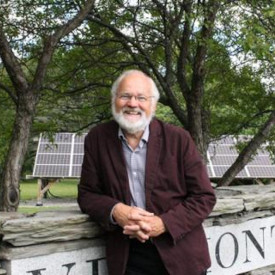

Pat Parenteau is emeritus professor of law at Vermont Law School and formerly served as EPA Regional Counsel. (Photo: Courtesy of Vermont Law and Graduate School)

PARENTEAU: Yes.

CURWOOD: Pat, as soon as this rule was filed, lawsuits were also filed by industry. And I gather that one of those lawsuits has advanced at the Fifth Circuit Court of Appeals, which has granted their motion to stay the rule. What is the practical effect of these lawsuits? And ultimately, what do you think it says about the ultimate fate of this rule the way that that court has responded to saying, stop?

PARENTEAU: Right, so there have been now lawsuits filed in six different US Courts of Appeal. The Republican attorneys general from 13 different states have filed these cases. And the Fifth Circuit, which is the most conservative court in the country right now, you might argue that Supreme Court itself is the most conservative, but certainly among the courts of appeals. The Fifth Circuit is pro industry, pro oil development, in particular, sits in New Orleans, Louisiana, did issue a stay on the SEC rule. It was a one line order, no explanation. This stay by the Fifth Circuit, will be in existence for a very short period of time. So its practical effect is limited. Because what happens now is there's a special panel, which will draw lots from a lottery to determine which of these six circuit courts where these cases are pending, will actually hear the case. Maybe it'll be the Fifth Circuit, maybe it'll be one of the other circuits. I don't think the stay order says anything about whether the rule survives. And, in addition to those challenging the rule as being outside of the SEC is authority. There is also challenges from the environmental side, saying the SEC erred by dropping the requirement for considering these so called Scope 3 emissions. And that case is pending in the DC Circuit Court of Appeals. And also in the Second Circuit Court of Appeals. Both of those circuits, have a majority of Democrat appointed judges, whereas the other circuits have a majority of Republican appointed judges. So you can see even in the context of where is this case going to be heard, and who is going to hear it and decide it, politics is playing a role in the ultimate fate of the rule itself.

DOERING: That’s Emeritus Professor Pat Parenteau of the Vermont Law and Graduate School, speaking with Living on Earth Host Steve Curwood.

NOTE: After we recorded our interview the Eighth Circuit Court of Appeals was designated as the court to hear the challenges to the SEC rule.

Links

Learn more about the SEC’s Adopted Rule

Reuters | “US Climate Rule Will Boost Sustainable Accounting Industry”

Wall Street Journal | “U.S. Appeals Court Temporarily Halts SEC Climate-Disclosure Rules”

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth